Understanding

the trend of Bank Nifty with application of Elliott wave, Channels and Moving

averages!

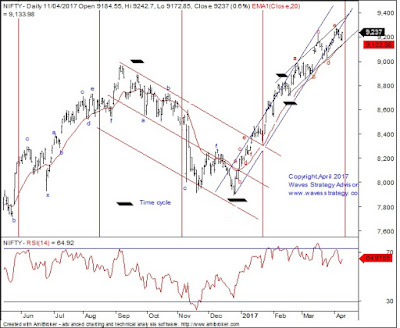

Nifty has shown

spectacular rally in last 3 trading session and prices have moved higher from

9075 to 9366 levels. Based on the basic as well as advanced concepts of

Technical analysis we were able to capture the up move and you can see detailed

research here. In last 3

months Bank Nifty has moved higher from 17600 to 22250 level till now. Although

the rally has been corrective in nature as per Elliott wave theory but it has

managed to follow 3 most important techniques which helps to ride the trend as

long as it goes. Below chart on Bank Nifty is taken from “The Financial Waves Short Term Update” which was published in today’s research

before the market open.

3 Techniques to follow the trend

of Bank Nifty:

20 Days Exponential moving

average: Moving average

is the simplest concept however one needs to check from Trial and error method

that which MA is suiting well to prices. 20 days EMA is providing excellent

support and recently prices reversed on upside from the same. Positional

traders can use this EMA as risk management.

Channeling technique: Before initiating any

positions, it is better to see on charts that which channel is working. Small

blue upward moving channel as shown below in daily chart has played its role

brilliantly and up move resumed when prices tested the channel support.

Bar technique: In the entire up move we have

observed that as long as prices continues to protect the low of prior bars on

closing basis, trend continued on upside. Whenever prices gave close below

prior bars low, consolidation was witnessed.

Bank Nifty daily chart:

(Part of research taken

from today’s research)

Wave analysis:

Bank Nifty has continued to provide major support to

the Nifty and this sub index is trading at the life time high. Let us look at

the short to medium term structure of this index to understand the trend ahead.

The daily chart of Bank Nifty shows that prices have

been respecting the short term upward moving channel. Recently prices made a

low exactly at the channel support and then sharply moved higher towards the

channel resistance. As per wave perspective, prices are in minor wave …. of third standard correction pattern and from here on it will be

crucial to see if it breaks the channel resistance or starts to move in

consolidation. Till that time it is better to follow the bar technique.

As per this technique as long as prior bars low is intact on downside trend

will be positive. 20 days EMA is proxy for the same which is constantly

providing support to the up move. Medium term support as per this MA is near

21380. Medium term investors in banking sector can use this

EMA as risk management strategy.

(60 mins chart with Elliott wave is not shown here

which is covered in research report)

In the last session high volatility was witnessed

which was in lines with that observed on Nifty as well during the day but

prices later managed to close near the high point of the day which will keep

positive trend intact. As shown on hourly chart, prices are now near the upper

end of the channel resistance. It is not very often to see break above the

upward sloping trendline but given the steepness it is prudent to avoid

catching a top and trading in direction of the trend. Any break of … level will decisively break the channel resistance and suggests

continuation of up move.

In short, Bank Nifty has immediate support at

psychological ……. mark followed by ……… level. Move above …. is required to extend this rally further as it is

also the equality level for wave c with that of wave a.

These are some

of the techniques which we follow to capture and ride the trend. However one

should also understand that continuous research is the key to be successful in

a market. It is crucial to understand the market dynamics so that one can keep

himself ready with different techniques.

Subscribe to “The Financial Waves Short Term Update” which covers Nifty, Bank Nifty and 3 different stocks on daily basis using

one of the most advanced and scientific approach to technical analysis using Elliott wave, Neo wave, Time cycles and much more. Nifty and Bank

Nifty has behaved exactly as the way expected and it is not very often to see

such high degree of accuracy. Get your copy NOW