VOLTAMP: Price Action with Powerful Indicators for Strong Returns

In the current market environment, there are stocks specific actions that can be witnessed. We can clearly see below the chart how bullish momentum can be captured.

Combination of trend indicator and price pattern is an amazing technique applied on a chart to understand why there was a rise and is this rise sustainable.

We published VOLTAMP analysis in "The Financial Waves Short Term Update" on 29th May which our subscribers received pre-market every day. Check out below the detailed research report that we published.

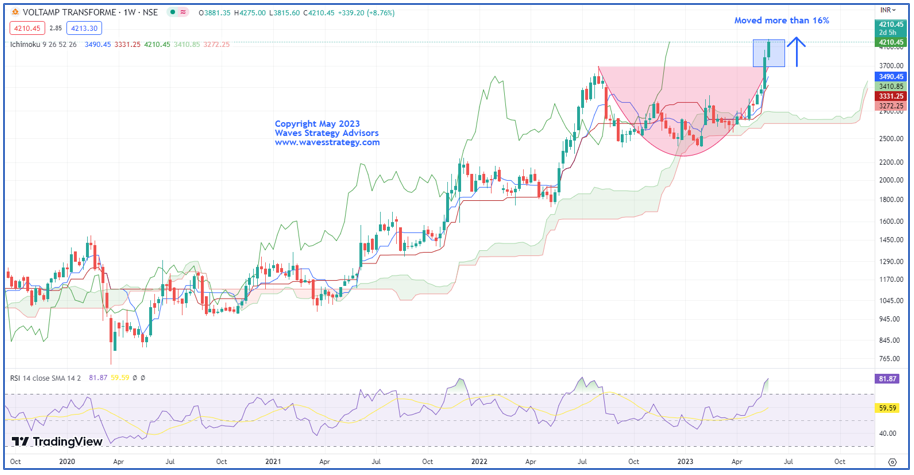

VOLTAMP Weekly chart Anticipated as on 29th May 2023

VOLTAMP Weekly chart Happened as on 31St May 2023

Wave analysis as on 29th May 2023

VOLTAMP has been moving higher recently and intact in strong uptrend. In the previous session it closed with a massive gain of 14.60%.

On the weekly chart, in the previous session prices formed a bullish candle. Price has close above 3692 level which confirm breakout of the rounding bottom pattern. Price is trading above the ichimoku cloud which indicate that the short-term bias is bullish. Closest support is placed at 3680.

In short, trend for this stock is positive. Use dips towards 3800-3840 as a buying opportunity for a move towards 4200-4250 levels as long as 3680 holds on the downside.

Happened: The stock moved as we expected. VOLTAMP have given a breakout of rounding bottom with huge volume which was a bullish sign. Within just 2 trading sessions, the stock made a high of 4275 levels which is more than 16% from the given levels. In such a volatile market, the stock is holding well at higher levels.

3 Months of Mentorship on Timing the Market – Above chart simply shows how price action along with Time cycle and Neo wave can be combined. A Mentor can ensure that proper application of these methods is passed across so that it can form a powerful system to generate that parallel source of income. Be a part of Elite traders community we call as #TimeTraders.