Nifty moved from near 18000 levels making a low of 17168 today post the FED meeting on 26th August. But this was predictable precisely as per Time and Neo wave pattern.

We have been warning since more than a week that we can see a crash and published it on YouTube as well – Here is the link if you missed seeing the webinar on 12th August – check here

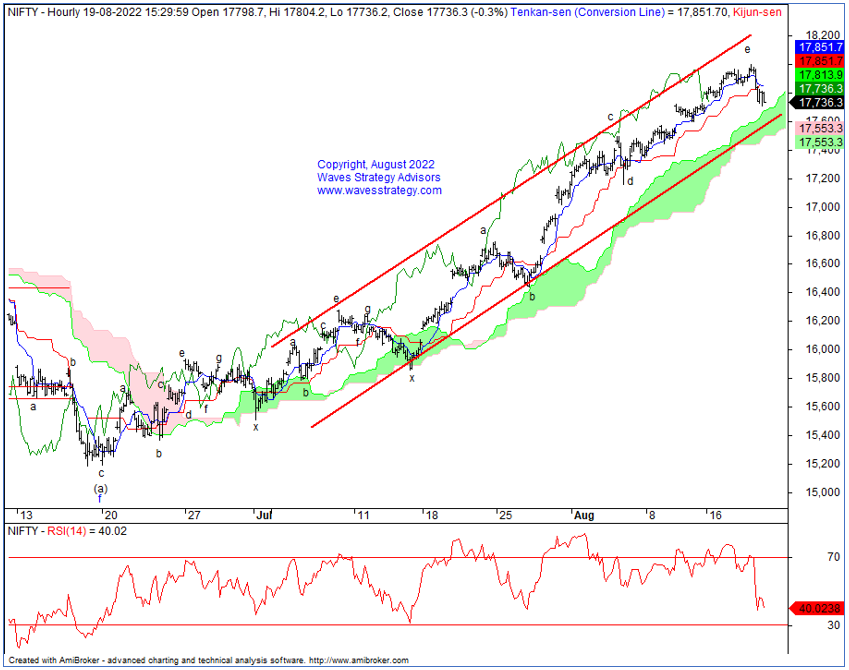

Following chart was shared to our clients which simply showed why we are nearing a top again at 18k when majority were super bullish for 18500++ levels.

We have been able to capture every single top on Nifty including the one formed in October 2021 near 18600. Many not ready to accept the facts presented at that time due to biasness and euphoria prevailing at that point of time. See the below charts:

Nifty Daily chart – Anticipated on 12th August 2022

Anticipated – Live streaming was done on @kyalashish YouTube channel with the headline - Nifty Lunar, 55 Days, Neo + OI! Nifty Crashed 2000 Points last time, Will it repeat? You can see it here

Nifty daily chart – Anticipated on 26th August 2022 much before the FED meet

Anticipated - #Nifty Evening star Candlestick pattern on Weekly chart, will history repeat?

Another webinar on 26th August 2022 Friday at 4 when we warned about a crash which was much before Fed meet – check it out here

Below chart shows areas of warning and move so far

Nifty is moving precisely as per 55 Days Time cycle, Lunar cycle and Elliott wave pattern. It is important to have these tools to trade extremely well and stay ahead of the crowd. During major turns one has to take opposite stand to the majority and we did that again this time when Nifty was nearing that 18k levels.

From here, we expect the pullback to be shallow. On upside 17480 is important resistance level and sharp rise in Open Interest at 17500 is also suggesting crossing that by this expiry is not going to be easy. So, pullbacks can be used to sell calls as long as 17480 remains intact on closing basis.

Most Advanced Technical Analysis Training – Master of Waves scheduled on 17th – 18th September is going to cover Elliott Wave, Neo Wave and Hurst’s Time cycles which can empower you to catch not only major tops and bottoms but also every single turn even on Intraday basis. Trade with an Edge, Early Bird Ends on 31st August 2022.

Know More