Below are the few key pointers I personally followed during

the ET Now stock trading game that helped me to win by substantial margin.

Understanding trend

using Elliott wave, Neo wave, Time cycles: First and most important thing

is to analyze the direction of Nifty and the broader market along with maturity

of ongoing trend. To do this I used Elliott wave, Neo wave and other advanced

technical analysis concepts for confirmation and maturity of the trend.

Avoid looking at overbought

or oversold readings: Next step involved looking at the outperforming

stocks. Intraday trade is all about capturing momentum rather than reversal. It

is better to avoid looking at overbought zone on RSI as a strong trending stock

will result into over bought values. Also avoid capturing reversals so a stock

which is already near new monthly or yearly lows should be preferred for

shorting and stocks that have managed to outperform the broader markets over

the period form a strong positive bar.

Channeling technique:

This is one of the most important methods that I use to determine the

resistance and support areas. If prices are lying near the upper end of the

channel it is better to avoid going long irrespective of the momentum whereas

if there is a big momentum bar formation from the channel support with a clear

higher highs and higher lows and the risk reward is favorable then the stock

can be shortlisted

Fibonacci

projections: To apply this it is important to understand basics of Elliott

wave so that the projections are done from the wave perspective. This helps in

deriving the target levels.

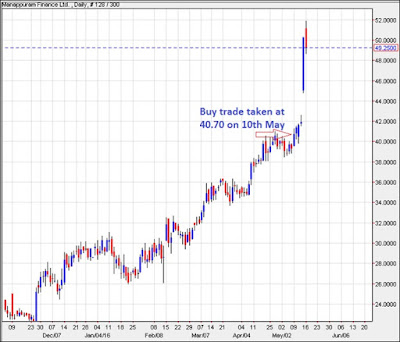

Now look at the example of one of the trades done on 10th

May 2016

Manapurram daily

chart:

Chart courtesy: netdania.com

Now the above chart is of Manappuram Finance one of the

stocks on which Long positions were taken on 10th of May based on

the techniques mentioned above.

The stock was up by 20%

after three days i.e. on 13th May. We have exited based on the

target levels but the point is to simply highlight the potential of the

strategy. Also it doesn’t matter whether the movement happened on back of news

or results because this stock was already in strong upside momentum even before

the news break out.

Training on

Trading strategy for Intraday / Positional trades using Momentum, Neo wave, Time cycles on 23rd and 24th

July 2016. Learn the in depth strategy followed during the show on ET NOW. Enroll Now and avail early

bird offer. Limited seats! Contact US

here or write to us at helpdesk@wavesstrategy.com or on +91 22 28831358 / +91 9920422202

Intraday / Positional

advisory: Subscribe for intraday / positional calls on Equity, Commodity,

Currency. Subscribe for 9 months and get special discount rates under Summer Offer.

No comments:

Post a Comment