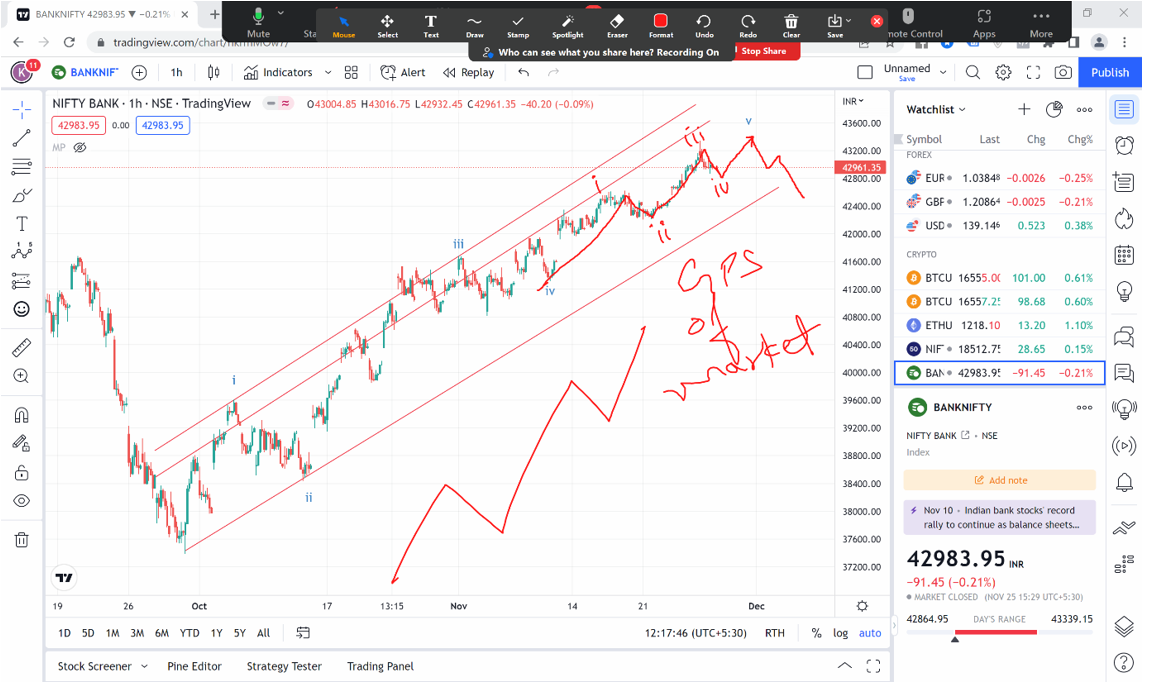

Elliott wave is GPS of market along with Fibonacci helps to understand Targets, Stoploss and maturity of trend.

Below chart of Bank Nifty was discussed during the Exclusive live webinar on 27th November 2022 with 1000s of participants where we derived possible path for this index.

Bank Nifty hourly chart (anticipated on 27th November)

Bank Nifty Trade basis of Fibonacci

Bank Nifty in today’s session is already breaking above the resistance of 43064 levels, Nifty touched lifetime high levels. The overall undertone is positive as long as we do not see close below the previous day’s low.

Post completing wave v on upside we can expect retracement of the up move. However, that has to be driven by two stage confirmation as per Neo wave – Advanced Elliott wave technique.

By combining simple price action along with Fibonacci and Elliott wave one can derive complete trade setup for Nifty, Bank Nifty and stocks.

In a nutshell, Bank Nifty trend looks positive as long as 42900 remains intact on downside for upside targets of 43350. It is important to understand this is game of probability and one should always trade when the probabilities are favourable.

Most advanced Training on Technical Analysis - Learn the science of Trading Options using Volume profile, Open Interest profile along with Elliott wave and Neo wave in upcoming Become Market Wizard (BMW) program which is comprised of two courses Options Trading using Technical Analysis (OTTA) on 10th – 11th December 2022 and Master of Waves on 7th – 8th January 2023. To know more fill below form - https://www.wavesstrategy.com/bmw/

No comments:

Post a Comment