Tuesday, December 21, 2021

Nifty Trading Strategy and Stocks For The Day

Friday, December 17, 2021

Nifty Neo Wave Pattern with Lunar Cycle

Thursday, December 16, 2021

What is Neo Wave? Why it is Must Tool for Trading?

Tuesday, December 14, 2021

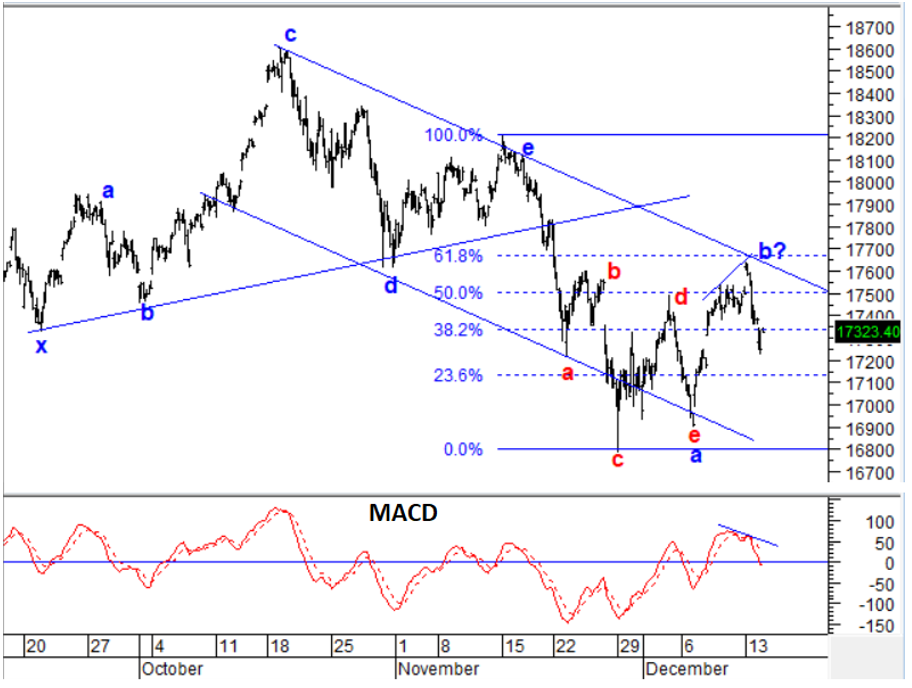

Nifty Elliott Wave, Fibonacci, MACD, Channels

Nifty Elliott Wave along with Channel and MACD indicator provide very good trade setups. This can be combined with Fibonacci ratios to understand the key reversal areas.

Nifty had continued to move in form of Gaps without any meaningful direction and thereby trapping both bulls and bears on either side. This only suggest that the rise had been in corrective fashion as long as we do not see break above the resistance levels.

Look at the below research highlighting different methods to provide high conviction trade setups

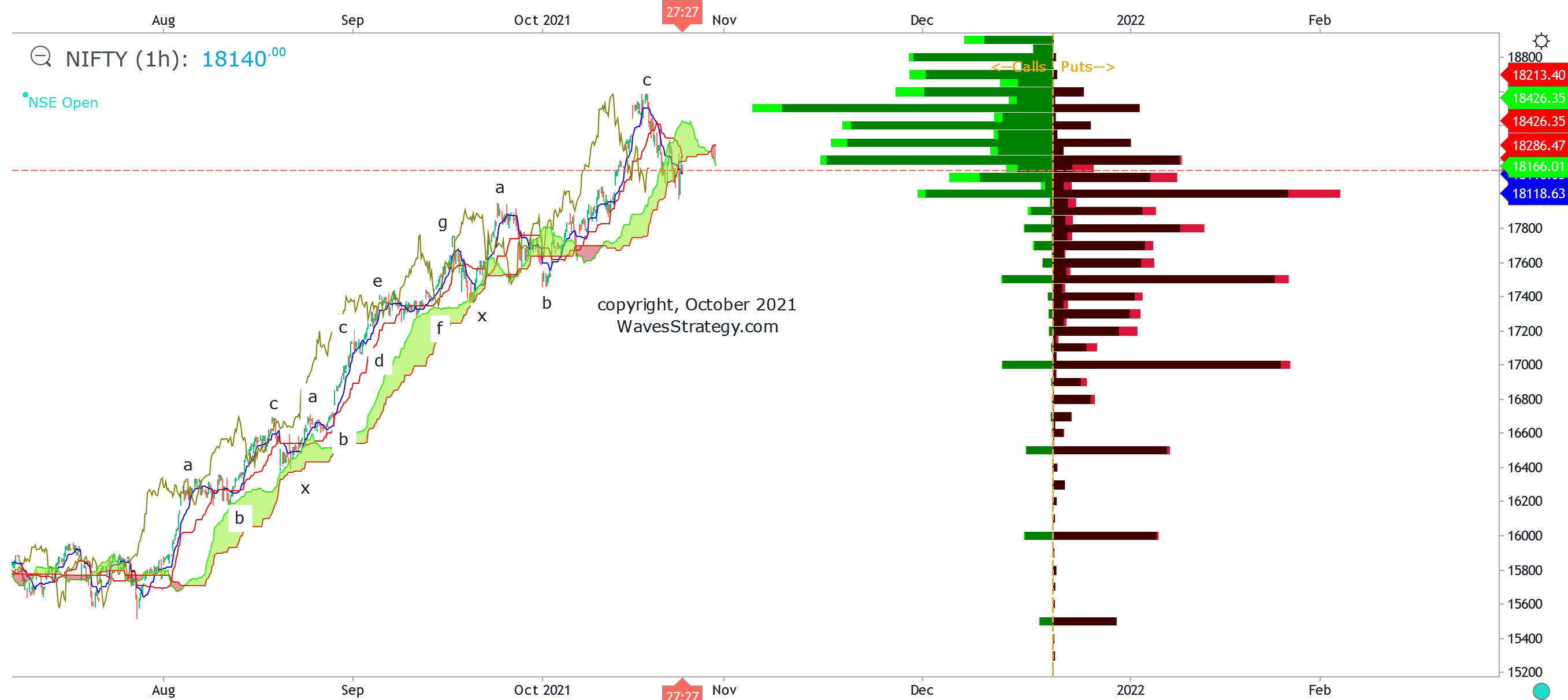

Nifty Hourly Chart :

Elliott wave analysis

Nifty post completion of wave e at the highs near 18200 levels Nifty moved sharply lower in the form of wave a (blue). This wave a formed an Extracting Triangle pattern and post its completion near 16895 there is a rise in the form of wave b. This wave b is either complete at the highs of 17600 or is still ongoing.

MACD Indicator – This clearly suggests negative divergence on minor degree from the highs and post that prices show a sharp reversal down. Now the MACD line is about to move below 0 thereby further indicating the overall trend can be sell on rise.

Fibonacci retracement – Nifty reversed from 61.8% Fibonacci retracement level of the entire fall. This hints towards the fact that the rise is corrective and medium term trend remains negative. This outlook will remains valid as long as Fibonacci level near 17650 remains protected. The reversal also happened

In a nutshell, by combining Elliott wave along with Channel, Fibonacci, MACD indicator one can form prudent trade setup and also forecast markets from few hours to months and years.

Subscribe to Equity calls and get free daily equity research report “The Financial Waves Short Term Update” that provide clear strategy using Elliott Wave and indicators on Nifty, Bank Nifty and stocks. Get access over here

Master of Waves – Learn complete Elliott wave, Neo wave along with Time Cycles and equip with excellent trade setups for trading Intraday and positional along with forecasting the markets from very hour, day and months. 2 Days of Live event on 15th – 16th January 2022, Early Bird ends on 25th December, Fill the form here for more details

Friday, December 10, 2021

Nifty Targets for coming week Using

Wednesday, December 8, 2021

Nifty 55 Days Time Cycle with 116 Hours Cycle post RBI policy!

Monday, December 6, 2021

Nifty Volume Profile with Elliott Wave For Accurate Forecasting!

Friday, December 3, 2021

Nifty Path Ahead - 55 Days Time Cycle, Neo Wave, Ichimoku

Wednesday, December 1, 2021

Nifty Trade Setup after the Crash, What is Next?

Friday, November 26, 2021

Options Trading Using Elliott Wave & Ichimoku Cloud For Coming Week

Thursday, November 25, 2021

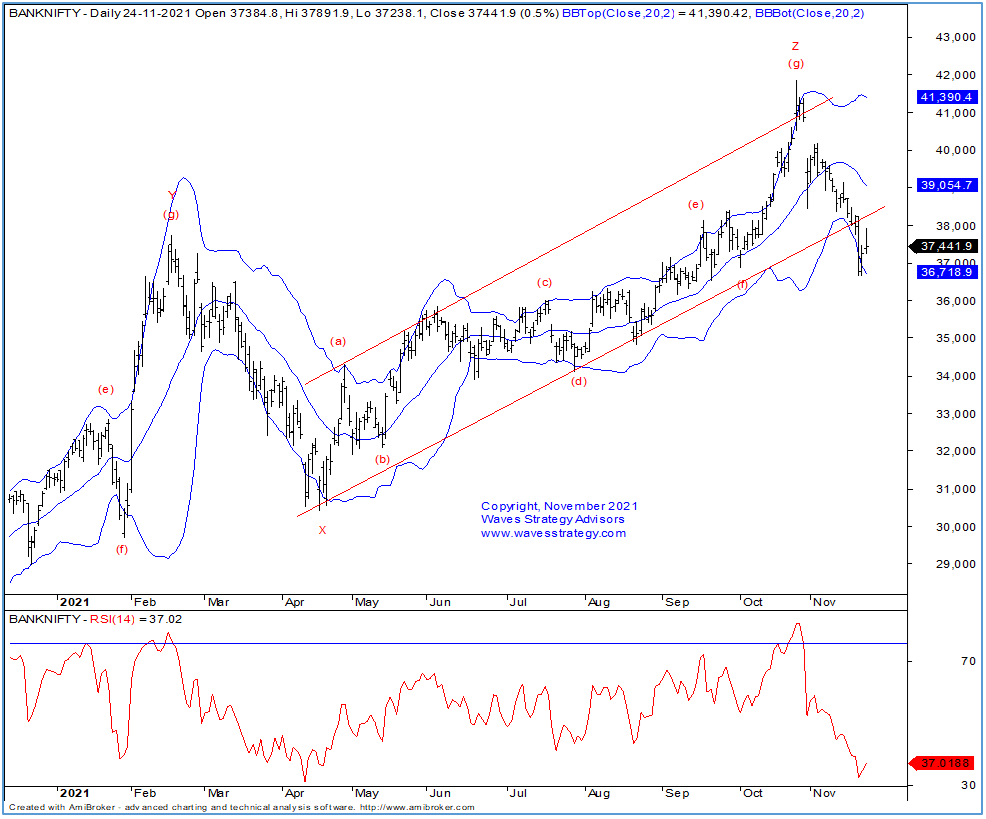

Bank Nifty Elliott Wave Diametric, Bollinger Bands® Open Interest Targets

Bank Nifty is following Advanced Elliott wave – Neo wave pattern amazingly well and when this is combined with Bollinger Bands, Channels and Candlestick it is possible to forecast with high accuracy.

Elliott wave becomes very useful during major reversals and gives us high conviction trade setups. See the below research which clearly highlights this fact.

Bank Nifty daily chart:

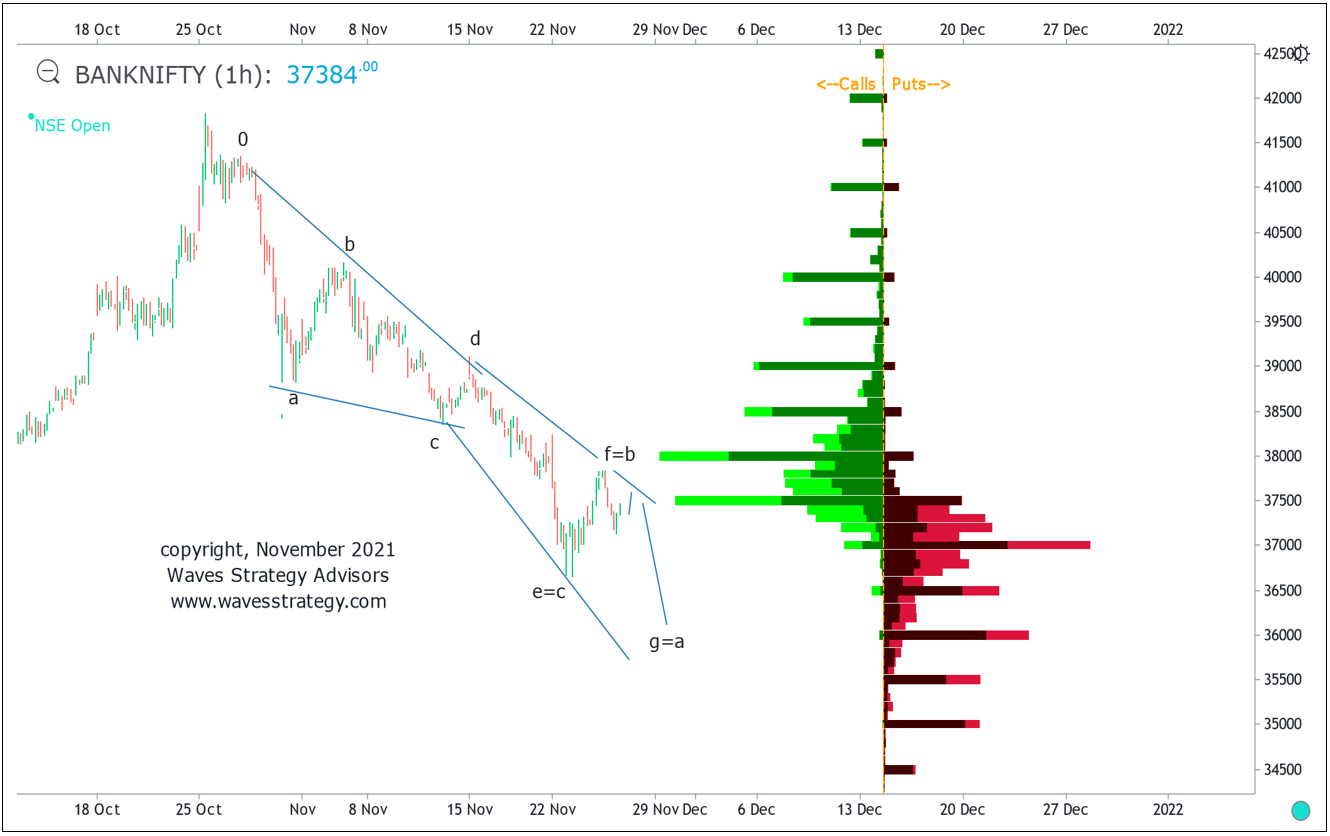

Bank Nifty hourly chart with Open Interest Profile

Elliott wave analysis:

On the daily chart, we can see that after completing minor wave g near 41800 level sharp fall has been witnessed which suggests that intermediate wave Z might have completed. Prices have made an attempt to bounce from the support of lower Bollinger band however till we do not see close above middle bands, we can expect weakness to persist. Looking at the break of upward rising channel support, there is high likely that trend can remain in sell on rise mode.

Bank Nifty Hourly chart Diametric pattern with Open Interest profile – Bank Nifty has been forming precise Diametric pattern which is a 7 legged correction. This pattern is described in Neo wave with all legs corrective in nature. Forecasting can be done as per following relationship between each of the legs as follows:

Wave g = wave a

Wave f = wave b

Wave e = wave c

The above is a guideline and helps a trader to trade accordingly. We are combining Open Interest profile as well along with it for high conviction trade setups

Open interest profile: suggests that there is highest call open interest at 38000 levels and highest change in Call OI is at 37500 and so crossing this zone can be challenging, whereas on the downside 37000 has highest Put OI and also the change. It seems that for bears to take back control we have to see decisive break below 37000 levels and for the up move break above 38k is must. Now that we have these crucial OI data and Elliott wave pattern it seems that there can be a minor pullback but not necessary post which Bank Nifty can start moving lower again towards 36400 – 36000 levels which is target as per Diametric pattern and also minor OI support.

In a nutshell, above research clearly shows that by knowing about Elliott wave, Neo wave patterns and combining OI data one can form excellent trading strategy either in Options or Futures. Many are focussing only on Options without knowing the market outlook which will not yield into any profitable outcome. It is therefore important for traders to focus on understanding these simple and easy techniques and then form Option strategies.

Most Advanced Training on Technical Analysis - Learn to Trade Options with step by step trade setups along with breakout strategy, Option Buying strategy, Volume and Open Interest profiling for Intraday, Swing trading, Also options can help to generate passive income if one understands the risk and accordingly take profitable positions. Become Market Wizard – BMW will combine Option Trading Using Technical Analysis (OTTA) on 11th – 12th December and Master of Waves (MOW) on 15th – 16th January. Trust me this will change you trade options and forecast the markets. Early Bird Ends on 30th November, know more here

Tuesday, November 23, 2021

NIfty crashed! Is It the Start of a Big Trend on 23-11-2021

Thursday, November 18, 2021

Nifty Intraday Trade Strategy using Ichimoku Cloud

Wednesday, November 17, 2021

Bitcoin – Is it Time to Buy? Time Cycle 58 Days

Crypto currency has been in news given the sharp rise in many of the crypto coins. Are you riding the trend?

A simple way to enter into Crypto currency like Bitcoin is to identify the days when the prices can reverse from down to up. Time tools are simple and effective way to time the trades or investments.

Let us see when will be time in favour to invest in Bitcoin.

Bitcoin Daily chart – 58 Days Time Cycle

Time Cycle analysis:

J. M. Hurst known as the father of cycles have done a lot of scientific work not only in space of physics but also in the application of Cycles on stock market. He identified a set of nominal cycles that is working across the scientific field and can be extended to the cyclicality of freely traded assets as well. We will not dwell into the theory as of now.

We have applied 58 days Time Cycle which is in close approximation to the Hurst’s Nominal cycle of 56 days on BTC/USD. The same looks to be working extremely well and we can see everytime prices formed a bottom on this cycle day on most of the occasions.

A few of the Time cycle helped prices to more than double in just a few weeks of time. This is the power of understanding when Time is in favour for investment or trading.

Next low as per Time Cycle on Bitcoin is near 12th December 2021. This clearly suggest that time will favour post 12th December. It is also possible to forecast price by using Time and it is an innovation by Hurst in field of Technical analysis.

So, now that the time will be in favour post 12th December it is possible to form a strategy accordingly for trading this crypto currency.

3 Months of Mentorship on Timing the Markets starts in 4 days – Mentorship starts from 20th November and it will focus on trade setups, time tools, Option strategy, Risk management, Stock selection methods, Multibagger portfolio creation and lot more. Are you part of this Elite group we calling as #TimeTraders? For more details Contact on +919920422202

Tuesday, November 16, 2021

Why Timing the Market is in focus for Upcoming Mentorship?

Timing the Market is the Key to trading success which can be achieved only when Price and Time are in sync. see in this video why Timing the Market is in focus for Upcoming Mentorship...If you want to be a part of this exclusive group simply register here - https://www.wavesstrategy.com/mentorship OR Contact us on +919920422202

We would love to connect with you on Social Media: Twitter - https://twitter.com/kyalashish/ Instagram - https://www.instagram.com/kyalashish/ Facebook - https://www.facebook.com/AKTradingGurukul Telegram - https://t.me/AKTradingGurukul LinkedIn - https://www.linkedin.com/in/ashishkyal/ ---------------------------- "SEBI “Research Analyst” No: INH000001097 Visit us : https://www.wavesstrategy.com/ Write to us on : helpdesk@wavesstrategy.com Contact us: +91 9920422202

Monday, November 15, 2021

Nifty Option Trading Using Open Interest Profile

Thursday, November 11, 2021

Smallcap Stock Comfort Fincap Time Cycles with Volume Profile

Wednesday, November 10, 2021

Nifty Profitable Trade setup using Ichimoku Cloud

Friday, October 29, 2021

Option Trading using Neo wave and OI Profile by Ashish Kyal, Author, CMT

Thursday, October 28, 2021

Nifty Crashed, Is it Lunar Cycle, What is Next?

Wednesday, October 27, 2021

TCI Express – Power Of Time Cycles.

It is possible to capture explosive moves in stocks using price patterns and advanced techniques like Time cycles.

Today morning we published TCIEXPRESS in "The Financial Waves Short Term Update" which our subscribers receive pre-market every day. Check out below the detailed research report that we published.

TCI Express Daily Chart as on 26th October 2021 (Anticipated)

TCI Express Daily chart as on 27th October 2021 (Happened)

TCI Express Hourly Chart

Waves analysis-

On the daily chart, in the previous session, the stock formed a bullish candle. We can see rounding bottom pattern has formed. Prices have given close above 281 level which confirms breakout from the pattern. Price is trading above the Ichimoku cloud which indicates that the short term bias is bullish.

On the hourly chart, the vertical lines represent 153 hour time cycle. As we can see that as prices approach this cycle an important low is formed. This helps us to time the market correctly. After the recent cycle of low formation, this is a perfect opportunity to buy.

In short, the trend for this stock is positive. Use dips towards 1760-1750 as buying opportunity for a move towards 1970-2000 levels as long as 1680 holds on the downside.

Happened-

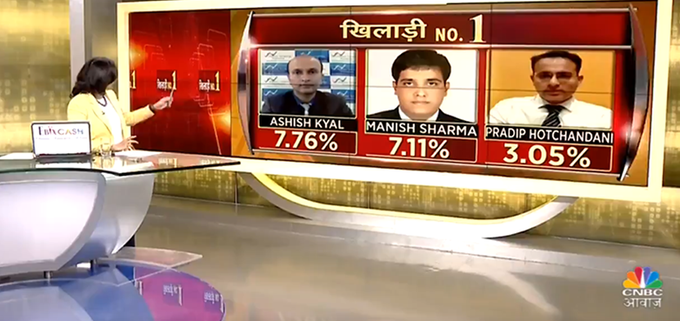

After we published the report the stock made a high near 1959 levels! We also gave a buy call on TCIEXPRESS on CNBC AWAAZ KHILADI NO 1 game show at 1785 and it hit 9% target at 1950 within a day!

Even in such elevated markets, want to know which stocks to pick up which gives better returns over the period of one year, this DIWALI. Get 4 stocks which are sector based outperformer. Subscribe to our this year Diwali Picks

Mentorship on Timing the Markets for the FIRST TIME EVER starts November 2021 – In this Mentorship program, all the necessary tools are given right from stock selection methods, strategy, follow-up action to derive a complete trade setup in step by step fashion. Contact us on +919920422202

Tuesday, October 26, 2021

IRCTC Time Cycles, When Will It Rally AGAIN!

Will Nifty Break 18k Levels Or Time To Buy, Elliott – Neo wave Pattern with OI?

Nifty has moved precisely as we expected and showed in previous research on 20th October 2021 – Nifty 3 Powerful Indicators

Now let us look at the same chart again and see what is expected from here on using Advanced Elliott Wave technique – Neo wave with Open Interest analysis

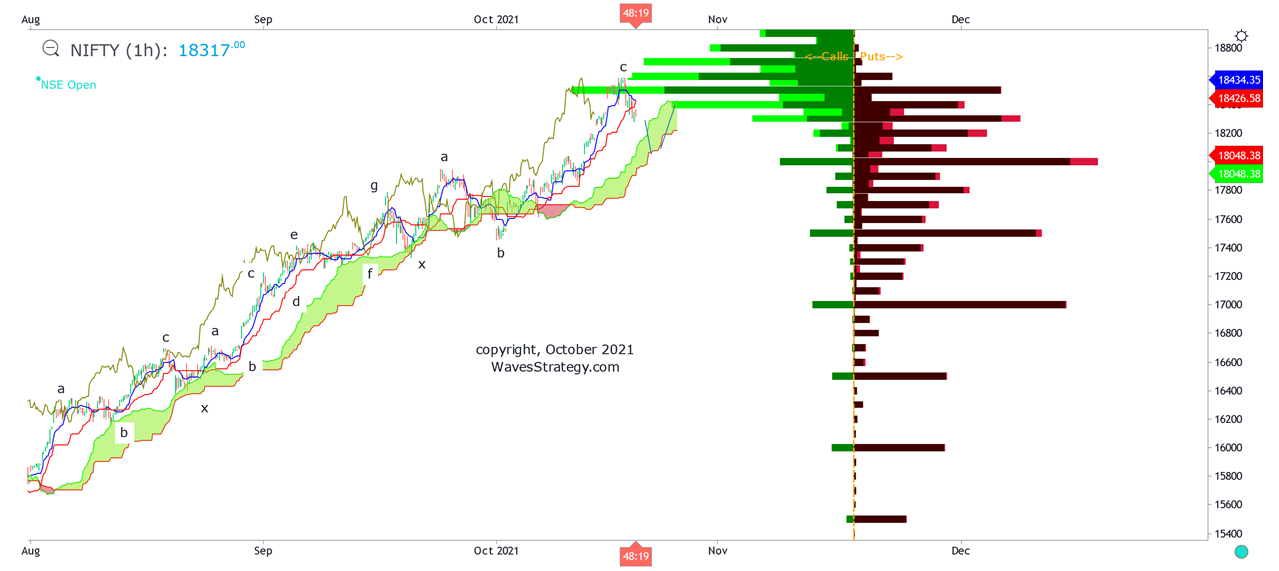

Nifty hourly chart:

We can see that prices are moving lower in the form of wave d and this pattern can either form a Diametric or a Neutral Triangle. Diametric is a 7 legged corrective pattern and Neutral triangle looks like a Head & Shoulder. We are currently moving in form of wave d and a bounce back above 18300 is required to confirm that wave d is over and wave e is starting higher.

Ichimoku Cloud - As of now we can see that prices are just moving near the lower end of the Ichimoku Cloud and we now need a break below 17970 for negative price confirmation. This will turn the overall setup into sell on rise and indicate a Neutral Triangle pattern is probably under formation. Combination of Ichimoku cloud along helps trader not only as a signalling method but also for deriving trades.

Open Interest Profile – Nifty OI profile continues to indicate that 18k is very important level with highest Put OI build there. A break below 17950 – 17930 zone will suggest that the puts will not get nervous and start covering their short positions thereby accelerating the selling pressure once 17950 breaks.

During this time Bank Nifty has continued to rally sharply on upside with stocks like ICICI Bank, Axis Bank moving up and on other hand stocks like IRCTC, IEX which have been traders favourite on long side are crashing. This will result into traders getting stuck and simply guessing what is going on. It is a typical scenario of a Triangle pattern formation and few days of consolidation can be expected. This is how one can understand Wave personality.

Thus the above 3 different techniques continued to suggest that markets are at crucial juncture and we need to either see a break below 17950 for a bigger downside correction or a move above 18300 for some positivity. Selling options is going to be ideal during such scenario to make money from ongoing volatile movement.

3 Months of Mentorship on Timing the Markets – Early Bird Ends on 25th October 2021, Time the market using Simple, Easy and Effective Time cycle trading techniques with combination of Step by step methods using Candlesticks, Timing tools and Elliott waves, complete handholding, stock selection methods, Algo creation, Option trading with a complete Trade plan, to know more contact us on +919920422202

Wednesday, October 20, 2021

3 Powerful Indicators on Nifty, You Cannot Miss!

By combining Ichimoku Cloud, Elliott Wave, and Open Interest analysis it is possible to form a powerful trade setup.

Diametric pattern is defined as per Neo wave and it consists of 7 legs. A peculiar behaviour of this pattern is that wave g tend towards equality with wave a, wave f tend towards equality with wave b and wave e tend towards equality with wave c.

Neutral Triangle Pattern: It is a triangle pattern in which wave c is the largest and wave d usually overlaps with wave a. This also looks like a topping Head & Shoulder pattern. Currently, Nifty is either forming a Diametric pattern or a Neutral Triangle and the nature of fall in wave d will confirm this.

Now look at the below chart for further understanding

Nifty 60 minutes chart:

Elliott wave analysis

Nifty on a 60 minutes time frame shows after Diametric pattern there was a dip in form of wave x and post that we might be forming a Neutral Triangle pattern or a Diametric again. Currently prices are in wave d of the same after forming a top in form of wave c near 18600 levels.

We are showing the path ahead on Nifty that can dip towards the Ichimoku cloud support and highest OI of Put option which is near 18000 and then there can be pullback on upside. This is also an assumption given the sharp fall of past few hours and rise in OI in call options near 18500 levels.

Open Interest analysis: OI profile chart shown along with prices gives further conviction for identifying key reversal areas. We can see that 18500 is near term resistance as there is high build up in OI for Call options of 18500 strike price and 18000 is highest OI for Put OI. Also 18400 is showing sharp rise in Call OI, so use pullback as shorting opportunity as long as 18400 – 18500 is intact and on downside expecting a move towards 18050 – 18k as per the path shown above. Also note this has to be evaluated as the market progresses and trade on basis of charts and patterns.

The above research clearly showcase how Ichimoku Cloud, Neo wave and OI profile can help in taking a clear trade setup for Option traders and form the strategy accordingly. These are simple yet powerful methods of forecasting and trading the markets.

Subscribe to the Multibagger, Momentum, Nifty / Bank Nifty calls that are derived on basis of these methods directly on WhatsApp / SMS and also get a research report along with it free to enhance your learnings.

Want to ride the momentum for 8% to 10% target with prudent risk reward and clearly defined stoploss – Get access to Momentum calls more here

Nifty / Bank Nifty calls – Want to trade only index on intraday or positional basis – check here

Mentorship on Timing the Markets: Mentorship starts in November that will ensure you become an Expert Trader with clear defined strategy, disciplined approach and science to forecast the markets. Time is the most essential element and we will provide over the period of 3 months all necessary tools required for one to become a profitable trader using Options. For more details Contact us on +919920422202.