Nifty crashed from 18k to below 17k levels and enough warning was given in our daily equity research and also following chart was published on 19th September 2022.

Traders were warned about upcoming reversal in Indian equity markets on basis of Time Cycles and we can now see Nifty even breaking below 17166 support and going below 17k levels.

Nifty daily chart (as on 19th September 2022)

Happened: Nifty hourly chart

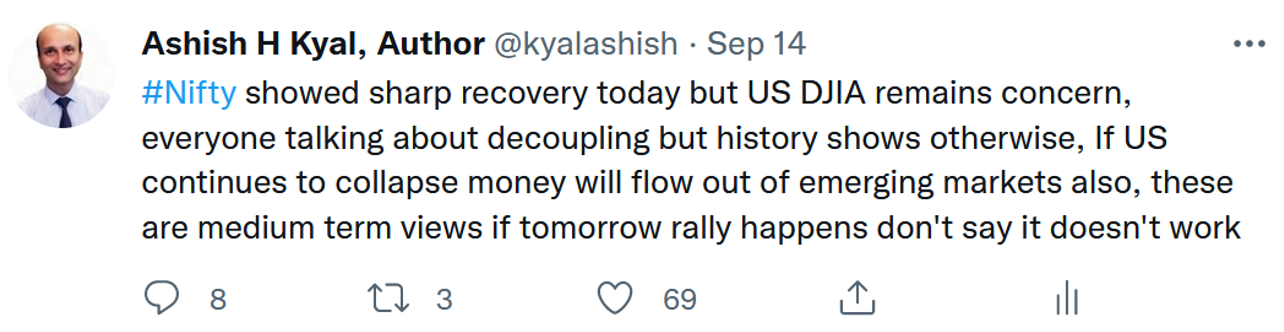

Following was flagged on 14th September when Nifty was reversing from near 18091 – Twitter @kyalashish

Over past few weeks we have been warning our subscribers and readers that the up move can be a trap and warned on 14th September and again on 19th September when prices were near 18k mark. This is for the 5th consecutive top that Nifty made we have been able to catch it precisely using Time cycle and Neo wave pattern along with simple indicators like RSI.

Infact we have also mentioned slowing momentum when prices were reversing and RSI indicator failed to show desired momentum.

Now as prices have moved below 17160 important support is broken as per 55 Days cycle and so bigger time will remain on the sell side and top at 18091 will not be taken out until 4th November 2022. This is vital information for option traders. Similarly short term Time Cycles can be used to take swing or intraday trades accordingly.

In a nutshell, Nifty remains in sell on rise mode as long as Gap near 17350 – 17400 is protected and breach below 16970 will further accelerate the selling pressure. Volatility can be high, sharp pullbacks possible but avoid getting trapped unless 17400 breaks.

Mentorship on Trading – Learn the science of Trading Time with simple step by step approach over the period of 3 months and get exclusive access to Master of Cycles program. Time is the most essential element to Trade and very few are talking about this science. Be a part of upcoming Mentorship on Trading with live trading sessions, Handholding, Stock selection, Time tools with no prior knowledge required. Check here for more details

No comments:

Post a Comment