Neo wave is an Advanced Elliott wave method with a greater number of rules and newer patterns to increase the overall objectivity. Whereas Elliott wave which was originally discovered by R. N. Elliott in 1930s. His original work mentioned that stock market does not move randomly but in systematic fashion. This systematic movement in prices are in form of waves. Normally there are 5 steps forward and 3 steps backward resulting into a net progression which is valid for stock market as well.

Any price movement as per basic Elliott wave is classified into Impulsive and Corrective. There are various patterns within these broader heads. Impulsive waves need to follow three basic rules:

1: Wave 2 cannot retrace complete of wave 1

2: Wave 3 cannot be the shortest of the directional waves 1, 3 and 5

3: Wave 4 cannot enter into territory of wave 1

The above 3 basic rules if followed then the price movement under consideration can be classified as a normal Impulse wave. However, when the market structure is complex there is possibility that the movement can be counted in many different ways. This can result into subjectivity and the entire purpose of wave theory can be lost. To overcome this limitation Neo wave was developed that has more than 15 different rules to define a simple impulse pattern. Following are a few of them:

1: Wave 2 cannot retrace more than 61.8% of wave 1

2: Wave 3 cannot be the shortest of the directional waves 1,3 and 5

3: Wave 4 cannot enter into territory of wave 2

4: There has to be at least one extended wave which is going to be 1.618% of non-extended wave. If there is no extension then the pattern under consideration is corrective

5: One of the directional waves should subdivide

6: Corrective waves should consume more time than the preceding impulsive wave

7: Touch point rule: Out of 6 points not more than 4 points should lie on the channel

8: …….

9: …. etc

The above shows only a few sets of rules for an impulse pattern as defined by Neo wave. I will be discussing all the rules more in detail in Sutra of Waves Online training happening on 12-13th July 2025.

– Diametric Pattern

– Neutral Triangle

– Extracting Triangle

These new patterns are equally important to understand because majority of the movement seen in the world equity markets are taking the forms of these patterns that were never covered in original work of R. N. Elliott.

Nifty Hourly Chart:

Neo wave chart shown above clearly shows different pattern combined together to form a complete price movement. Predicting this pattern helps to be in the right side of the trend.

Neo wave chart shown above clearly shows different pattern combined together to form a complete price movement. Predicting this pattern helps to be in the right side of the trend.

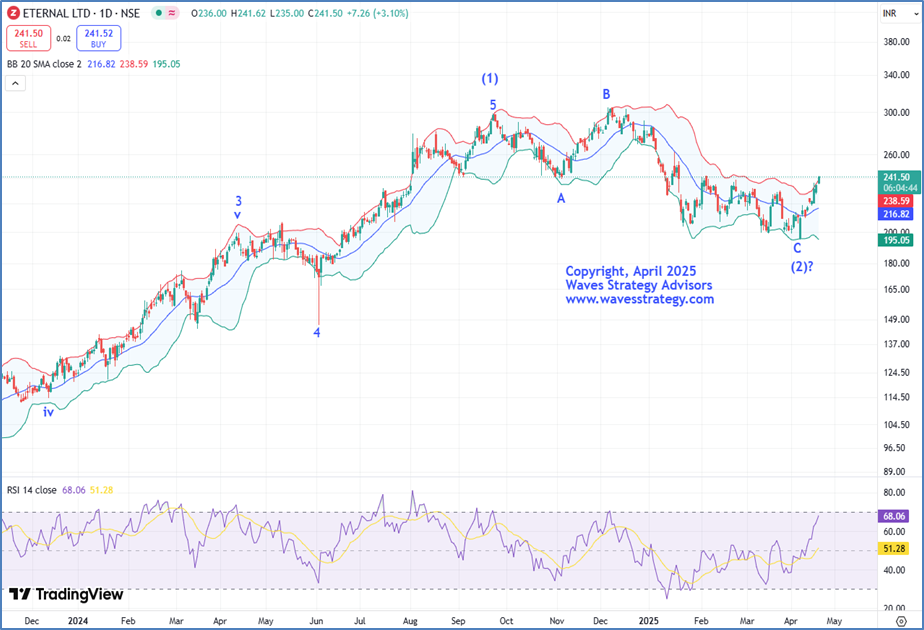

Post completion of Primary wave (d) on the downside, the entire move has been corrective in nature. Wherein, we have witnessed different kinds of corrective patterns like Elongated zigzag (5-3-5), Flat (3-3-5), Zigzag (5-3-5) and Diametric pattern (3-3-3-3-3-3-3). The above chart shows practical implication of different corrective pattern.

As one can observe that the Index moved exactly as per the Neo wave counts and wave e(blue) recently got completed on the upside in the form of a 7-legged Diametric pattern and post which the fall was in the form of wave f(blue). We are now expecting wave g higher to start as wave f has shown price and time wise equality as compared to wave b because as per the guideline wave b tends to equal to wave f. For now, a break above 25670 levels can confirm completion of wave f(blue) on the downside and post which the rise can be in the form of wave g(blue).

In a nutshell, one can use this one powerful method – Neo wave for taking such bold trades & riding against the majority when no one expected it. Thrilled Yet!

Sutra of Waves (SOW) – Elliott wave has a few rules making it subjective at times but Neo wave has more rules and newer patterns like complex correction, Diametric, extracting triangle, that makes trading a lot more objective. Combine this with price action and Fibonacci trading system and see the magic of systematic trading using this scientific approach of trading. Limited seats only, Live session on 12th – 13th July. You can enroll from here. Register here

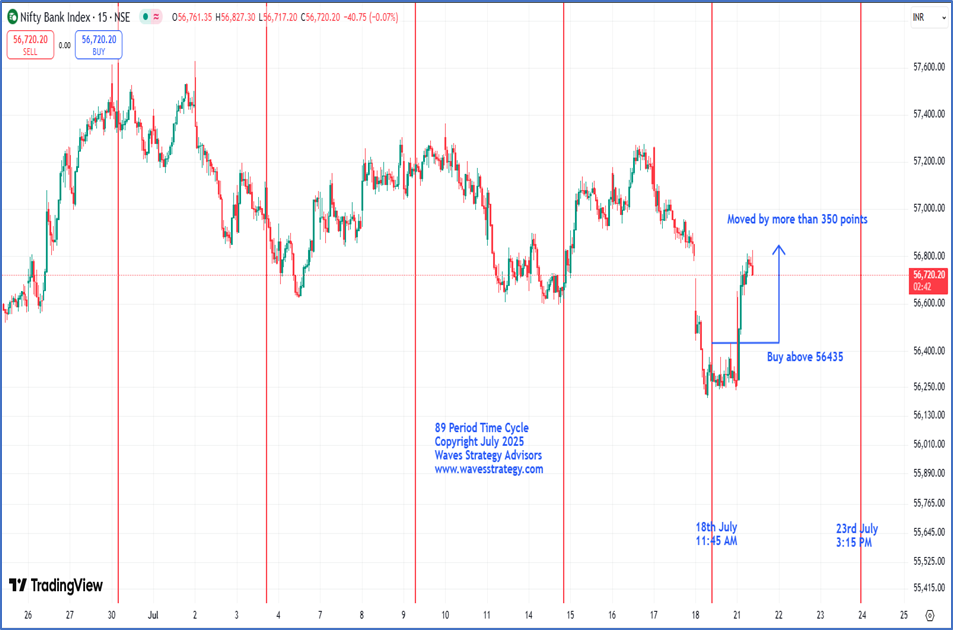

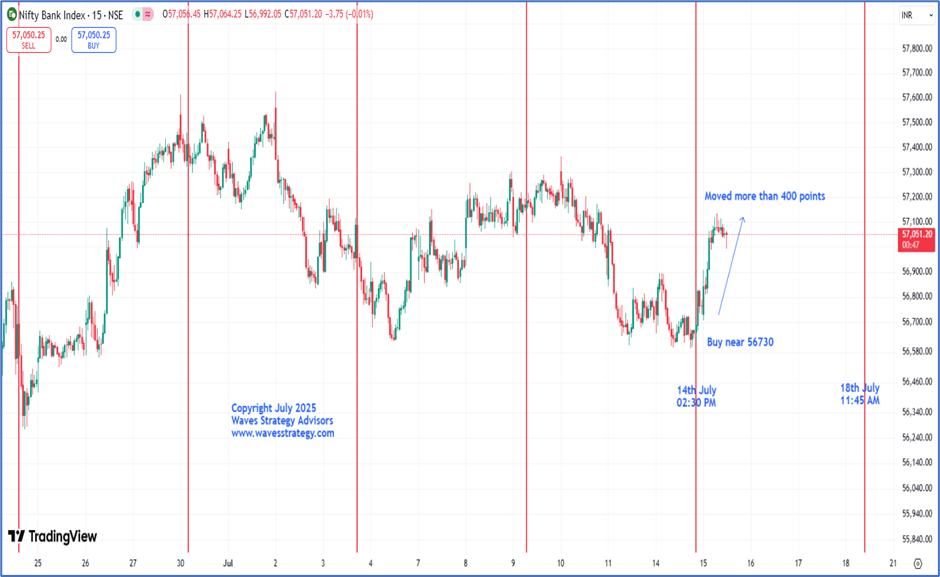

We used the concepts of Hurst’s Time Cycles and found actual cycles working on Gold prices. It is amazing to see how fractal nature of Time cycles can help us catch reversals on every time frame.

We used the concepts of Hurst’s Time Cycles and found actual cycles working on Gold prices. It is amazing to see how fractal nature of Time cycles can help us catch reversals on every time frame.