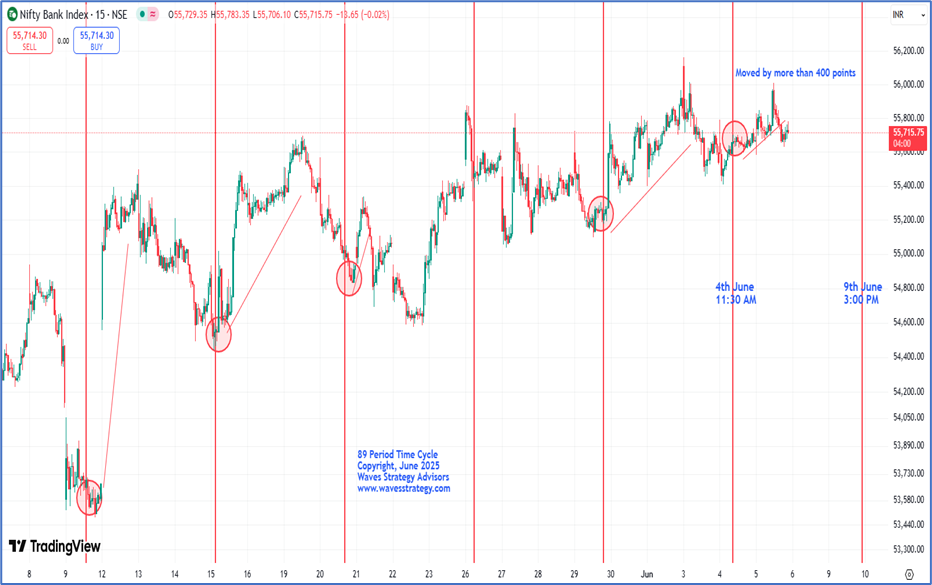

It is fascinating to see how with the help of Neo wave one can anticipate a move before it happens on Indices and even on Commodities.

We have been tweeting about Nifty and Crude Oil movement from time to time on my twitter (X) handle @kyalashish and the move has been just precise. See the details about it below:-

Nifty Hourly chart: Anticipated in a Tweet as on 23rd June 2025 Nifty Hourly chart: Happened as on 24th June 2025

Nifty Hourly chart: Happened as on 24th June 2025 In the 1st chart, we have shown possible path for Nifty which was tweeted on 23rd June 2025, where we anticipated that if Nifty manages to give sustainable close above 25050 levels then it can lead to a move towards of 25200 or higher which will be in the form of wave (iii).

In the 1st chart, we have shown possible path for Nifty which was tweeted on 23rd June 2025, where we anticipated that if Nifty manages to give sustainable close above 25050 levels then it can lead to a move towards of 25200 or higher which will be in the form of wave (iii).

Bang on! Nifty continued to move higher post achieving target of 25200 and prices made high of 25317 levels in today’s session. As per the wave theory, wave (iii) has started to unfold on the upside but for now, we need broader participation and a daily close above 25200 levels for buying to continue.

Crude Daily chart: Anticipated in a Tweet as on 20th June 2025 Crude Daily chart: Happened as on 24th June 2025

Crude Daily chart: Happened as on 24th June 2025 The second anticipated chart is of Crude Oil of 20th June 2025, in which we showed a possible path ahead using Neo wave counts. Bang on!

The second anticipated chart is of Crude Oil of 20th June 2025, in which we showed a possible path ahead using Neo wave counts. Bang on!

Prices completed wave (f) on the upside and we have seen a sharp fall of more than 14% in just 2-3 days from the high of 6550 levels, post the news about the Ceasefire between Iran and Israel came out. However, we predicted about the possible correction when prices were trading at the top, when no one was expecting it.

For now, as per the guideline, wave (g) tends to mimics wave (a) which further leaves room for the asset to move on the downside.

AGNI (index) Research - Get access to daily research reports on Nifty along with charts, and options strategy. Know more.

Sutra of Waves – (Elliott wave and Neo wave) SOW program will focus on application of Elliott wave / Neo wave along with Ichimoku cloud, Fibonacci trading system, forecasting from intraday to swing trading strategy, 12th – 13th July for live training but access to Elliott wave is given on immediate basis. Limited seats only, Early bird ends on 25th June 2025. Know more here

Trishul membership consists of Options Mantra, Elliott wave, Sutra of Wave, Know more here

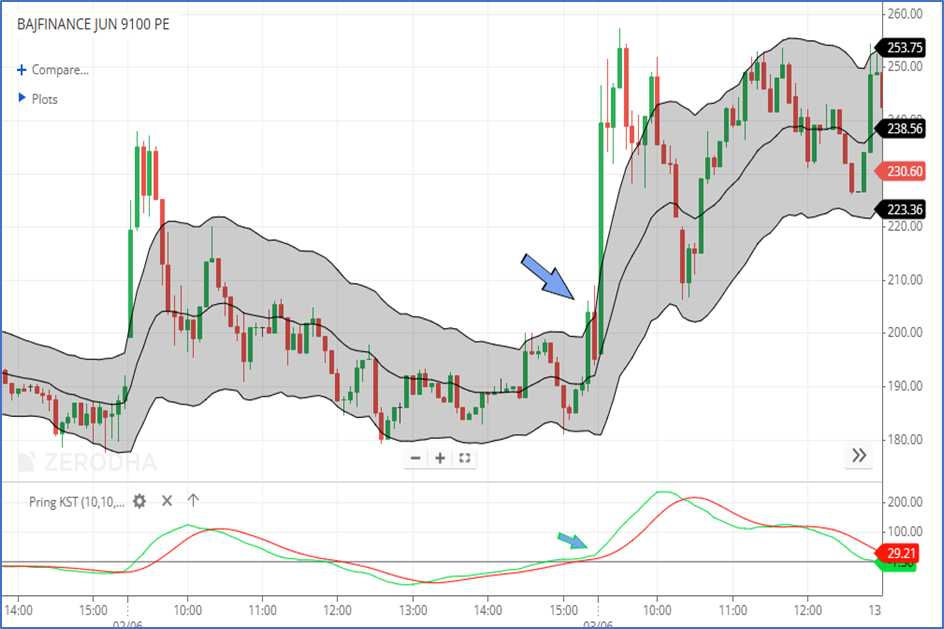

Bajaj Finance Ltd Daily chart with Gann levels: Anticipated as on 26th May 2025

Bajaj Finance Ltd Daily chart with Gann levels: Anticipated as on 26th May 2025

Jindal Stainless 660 Call Option 15 mins chart:

Jindal Stainless 660 Call Option 15 mins chart: