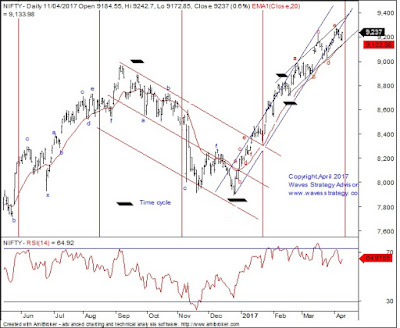

Nifty: Power of Hurst’s Time cycles along with Neo wave Diametric pattern!

Time cycles are

extremely important concept and when combined with other technical analysis

methods it gives high probable outcome.

Below research

shows how we are using Hurst’s Time cycles with Neo wave

application on Nifty.

This time we

are again visiting 55

days Time Cycle which has worked well in past. We found out this cycle based on Hurst

cycle study which has predefined standard cycles. One can find cycles which are

close to the nominal ones defined in the nature. This cycle had been working well over the past

history.

In cycle

analysis one should give leeway of 10% as Time is more dynamic element compared

to price. Low formed on Demonetization was just 2 days later when the cycle was

bottoming out.

Plot your

own charts with cycle analysis on Nifty and share it across on our Trader’s Forum for collaborative learning or clarifying your doubts or sharing

something extremely exciting with everyone.

Below chart is

picked up from the daily equity research report – The Financial Waves short term update that covers view on Nifty and

three different stocks published daily.

Nifty daily chart:

Wave analysis:

Published

today morning in equity research report

Nifty had a flat opening

in yesterday’s session and prices managed to quickly move towards 9240 on

upside during first half of the session. Later there was consolidation

throughout the day within a narrow range of 9220 and 9240 levels. Stock

specific action continued with heavy weights like ICICI Bank, ITC, Bank of

Baroda helping index to close positive.

As shown on daily chart,

over past 4 days Nifty corrected by hardly 100 points and recovered back

quickly on upside in just one day. The broader market has been still

outperforming during this period. It therefore indicates that the ongoing leg is

only wave f and post its completion wave g on upside should start.

We are showing 55 days Time cycle on the daily scale. As per this cycle an

important low should be formed by ……… April. The reason for giving a range is

because we do not have precise level to pick up post the Demonetization. The

cycles got little distorted and so we will use the range rather than picking up

exact low date. This time as well prices moved in sideways action in the cycle

topping zone rather than downside so far. This is in sync with the existing

wave counts.

As shown on hourly

chart, (shown in the actual

research report) after the fall and rise scenario the best tool to use is Bollinger

Bands for directional breakout confirmation. Nifty made a high near 9245 levels

which was exactly at the upper end of the bands. The lower end of the band is

near 9170. We can expect range bound action between this zone over next few

days before the time cycles are behind us and prices confirm a low formation by

…… above the high of …….. levels.

Nifty has moved precisely within the zone mentioned in today’s morning

research report…

Subscribe NOW to the daily equity research report and get the Monthly research

absolutely free over the period of 12 months. At times it is important to know

the Elliott wave counts right from hourly charts to the monthly charts which

give holistic perspective from trading to investments decisions!

.png)

.png)

No comments:

Post a Comment